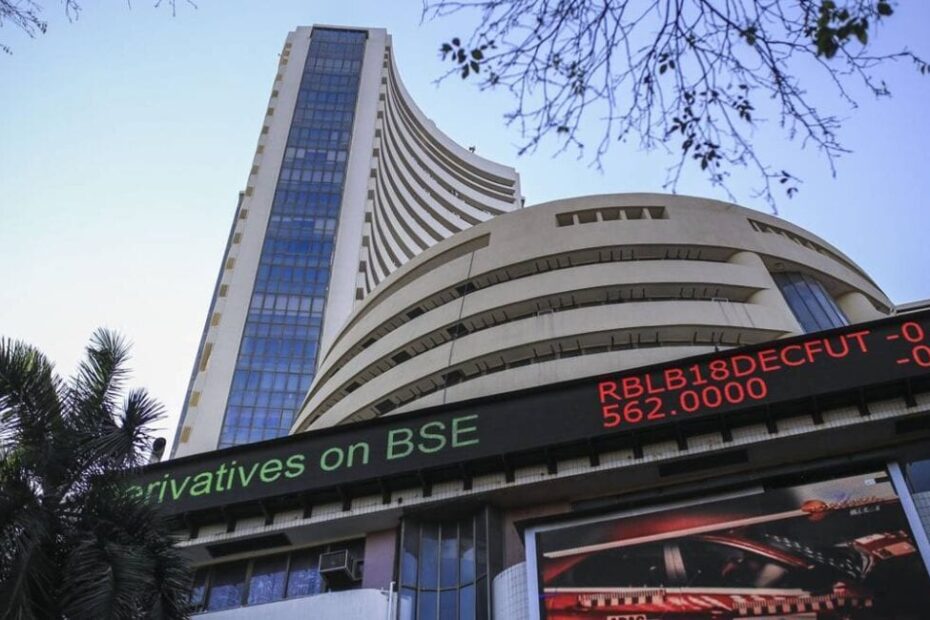

BSE Ltd., Asia’s oldest stock exchange, has recently witnessed a remarkable surge in its share price. This upward trajectory can be attributed to the combination of regulatory changes, strategic moves, and strong financial performance that have encouraged investor confidence. In this article, we’ll explore the five key reasons driving BSE’s share price to new heights.

1. Regulatory Advantage: A Game-Changer for BSE

One of the most significant factors propelling BSE’s share price is the recent regulatory shift introduced by the Securities and Exchange Board of India (SEBI). SEBI has implemented new rules that limit the number of weekly derivatives contracts per exchange. This change provides BSE with three additional trading days for expiry contracts, allowing it to operate longer compared to its main competitor, the National Stock Exchange (NSE).

Impact:

- Increased Trading Volume: With more trading days available for derivatives, BSE has a unique opportunity to boost its trading volume significantly.

- Competitive Edge: The additional trading days enable BSE to compete more effectively against NSE, which historically dominates the derivatives market.

- Market Optimism: Investors view this regulatory advantage as a pivotal opportunity for BSE to increase its market share, leading to positive sentiment and a spike in its share price.

2. Launch of New Indices and Products

BSE’s proactive strategy in launching new indices and products has also been instrumental in driving its stock price upwards. Recently, BSE introduced new indices like the BSE Sensex Sixty and the BSE Power and Energy Index. These initiatives aim to broaden BSE’s product offerings and enhance its visibility and influence in the market.

Benefits:

- Diversification of Offerings: By introducing specialized indices, BSE appeals to a wider range of investors, including those focused on specific sectors like power and energy.

- Increased Trading Activity: These new products are designed to attract more trading volume, which directly contributes to revenue growth.

- Enhanced Market Presence: Expanding its product portfolio helps BSE establish itself as a versatile and dynamic player, boosting investor confidence and share price.

3. Revision of Transaction Fees

BSE’s strategic move to revise its transaction fees has also played a crucial role in the rise of its share price. The exchange recently adjusted its transaction charges for key products such as Sensex and Bankex options, with the new pricing structure coming into effect in early October.

Positive Outcomes:

- Revenue Growth: The revision is expected to lead to increased revenue from higher trading volumes, as traders take advantage of the more competitive fee structure.

- Market Perception: Investors perceive this change as a proactive measure by BSE to enhance its profitability, which, in turn, has positively impacted the stock price.

- Alignment with Market Trends: The fee revisions demonstrate BSE’s responsiveness to market dynamics, further strengthening its position in the eyes of investors.

4. Strong Financial Performance Despite Challenges

Despite a challenging market environment and a decline in net profits, BSE has shown resilience through robust revenue growth, particularly in its derivatives segment and other new product offerings. The exchange’s ability to maintain and even expand its revenue streams during volatile periods has been a key factor in investor confidence.

Highlights:

- Diversified Revenue Streams: BSE’s focus on expanding its offerings beyond traditional products has led to an increase in revenue, showcasing its ability to adapt to market changes.

- Derivatives Growth: The derivatives segment has been a strong performer, with the regulatory changes further supporting growth prospects.

- Resilient Business Model: BSE’s diversified approach and steady financial performance, even in a fluctuating market, have reassured investors of its long-term growth potential, pushing the stock price higher.

5. Market Sentiment and Investor Confidence

All these factors collectively have generated a positive sentiment around BSE in the market. The exchange’s strategic initiatives, regulatory advantages, and strong financials have fostered a sense of optimism among investors. As a result, demand for BSE’s shares has surged, leading to a substantial increase in its stock price.

Contributing Factors:

- Perception of Growth Potential: Investors are optimistic about BSE’s ability to grow and expand its market share, especially in the derivatives market.

- Long-Term Confidence: With BSE continuously adapting to regulatory changes and launching new products, investors view it as a company with a solid growth strategy, leading to sustained buying interest.

- Increased Liquidity: As more investors flock to BSE’s stock, liquidity increases, further driving up the share price.

Conclusion

The rally in BSE Ltd.’s share price is not a mere coincidence; it is the result of a combination of regulatory changes, strategic initiatives, and robust financial performance. The SEBI regulations have provided BSE with a competitive edge, while new product launches and transaction fee revisions demonstrate its adaptability. Coupled with strong revenue figures and positive investor sentiment, these factors have propelled BSE’s share price to an all-time high, reflecting the market’s confidence in the exchange’s growth prospects.

BSE’s ability to navigate market dynamics and leverage regulatory shifts showcases its potential to continue its upward trajectory, making it a stock to watch in the Indian financial market.